Tax returns are complicated. To add to their complexity, investment income generated by stocks, bonds, and other investment assets may be taxed differently than your other sources of income. Investment income includes capital gains and losses.

WHAT ARE CAPITAL GAINS AND LOSSES?

If you sold an investment this year, a capital gain or loss is likely involved. Your investments that have increased or decreased in value contain “unrealized” capital gains or losses. Once you sell your investments, the gains or losses are considered “realized” and may be taxed.

HOW DO YOU CALCULATE CAPITAL GAINS AND LOSSES?

FIRST: IDENTIFY YOUR INVESTMENT’S “BASIS”

Before you calculate your capital gains and losses, you must identify your investment’s initial and adjusted basis. If you purchased the asset, your initial basis is the amount you paid for the asset. Your basis may differ for assets that were gifted or inherited. Your adjusted basis accounts for changes to the investment’s initial basis from events such as capital improvements or depreciation, inheritance, or stock events (such as a stock split with a dividend that is paid in additional shares).

CALCULATION:

Once you identify your basis, you can calculate your gains and losses. This is because a capital gain or loss is calculated by subtracting your adjusted basis (or initial basis if an adjusted basis is not applicable) from the amount you realize from the sale, which could be cash only or could include other property of value.

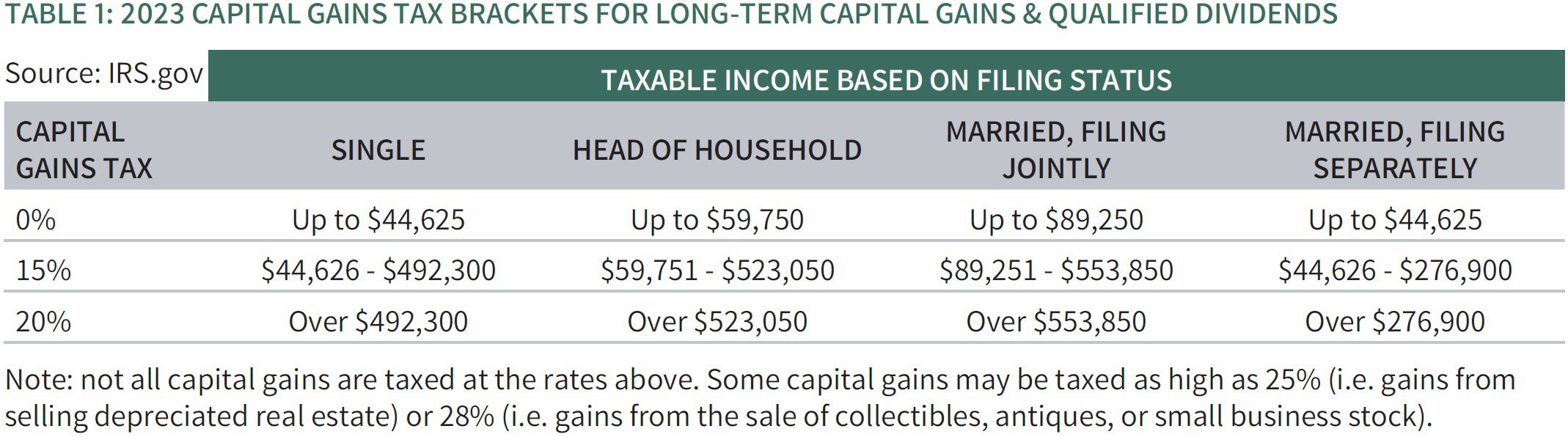

Realized long-term capital gains (for assets held over a year) are generally taxed at lower tax rates than ordinary income. Keeping track of your holding period, or the length of time you have held an asset is important for this reason. These tax rates are generally 0%, 15%, or 20% depending on your taxable income (see Table 1 below). The same holds true for qualified dividends, which are usually dividends from either domestic corporations or qualified foreign corporations. Short-term capital gains, or gains on assets held for under a year, are taxed at ordinary income rates, which vary based on your filing status and ordinary taxable income bracket. Calculating the tax on your capital gains can be challenging due to the complexity around identifying the proper adjusted basis as well as the various rates that may apply.

CAN CAPITAL LOSSES REDUCE YOUR TAX LIABILITY?

Capital losses can be used to offset capital gains. If your losses exceed your gains, you can use your net capital loss to offset up to $3,000 of other ordinary income per year ($1,500 for those who are married, filing separately) on your income tax return. If your net losses exceed this $3,000 limit, they are carried forward indefinitely and can be used to offset future gains.

CONCLUSION:

The tax impact and reporting of realized capital gains and losses are complex. We recommend consulting with your tax advisor for guidance related to your situation. In addition, our internal tax team is available should you have any questions or need additional assistance.

For more information, visit the IRS website.

Author: Marc Verdi | CFO and Director of Tax & Financial Planning Written: December 21, 2023